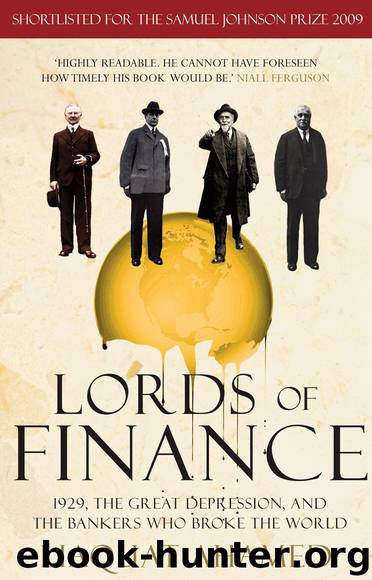

Lords of Finance by Liaquat Ahamed

Author:Liaquat Ahamed

Language: eng

Format: epub

Publisher: Penguin USA, Inc.

Published: 2015-02-19T16:00:00+00:00

PART FOUR

REAPING ANOTHER WHIRLWIND

1928-33

16. INTO THE VORTEX

1928-29

At particular times a great deal of stupid people have a great deal of stupid money. . . . At intervals . . . . the money of these people—the blind capital, as we call it, of the country—is particularly large and craving; it seeks for someone to devour it, and there is a “plethora”; it finds someone, and there is “speculation”; it is devoured, and there is “panic.”

—WALTER BAGEHOT

THE GREAT BEAR of Wall Street legend, Jesse Livermore, once observed that “stocks could be beat, but that no one could beat the stock market.” By that he meant that while it was possible to predict the factors that caused any given stock to rise or fall, the overall market was driven by the ebb and flow of confidence, a force so intangible and elusive that it was not readily discernible to most people. There would be no better evidence of this than the stock market bubble of the late 1920s and the crash that followed it.42

The bubble began, like all such bubbles, with a conventional bull market, firmly rooted in economic reality and led by the growth of profits. From 1922 to 1927, profits went up 75 percent and the market rose commensurately with them. Not every stock went up in the rise. From the very start, the 1920s market had been as bifurcated as the underlying economy—the “old economy” of textiles, coal, and railroads struggling, as coal lost out to oil and electricity, and the new business of trucking bypassing the railways while the “new economy” of automobiles and radio and consumer appliances grew exponentially. Of the thousand or so companies listed on the New York Stock Exchange, as many went down as went up.

The first signs that other, more psychological, factors might be at play emerged in the middle of 1927 with the Fed easing after the Long Island meeting. The dynamic between market prices and earnings seemed to change. During the second half of the year, despite a weakening in profits, the Dow leaped from 150 to around 200, a rise of about 30 percent. It was still not clear that this was a bubble, for it was possible to argue that the fall in earnings was temporary—a consequence of the modest recession associated with Ford’s shutdown to retool for the change from the Model T to the Model A—and that stocks were being unusually prescient in anticipating a rebound in earnings the following year. The market was still well behaved, rising steadily with only a few stumbles, and without the slightly crazed erratic moves and frenetic trading that were to come.

It was in the early summer of 1928, with the Dow at around 200, that the market truly seemed to break free of its anchor to economic reality and began its flight into the outer reaches of make-believe. During the next fifteen months, the Dow went from 200 to a peak of 380, almost doubling in value.

That it was so

Download

This site does not store any files on its server. We only index and link to content provided by other sites. Please contact the content providers to delete copyright contents if any and email us, we'll remove relevant links or contents immediately.

International Integration of the Brazilian Economy by Elias C. Grivoyannis(111057)

The Radium Girls by Kate Moore(12028)

Turbulence by E. J. Noyes(8047)

Nudge - Improving Decisions about Health, Wealth, and Happiness by Thaler Sunstein(7706)

The Black Swan by Nassim Nicholas Taleb(7128)

Rich Dad Poor Dad by Robert T. Kiyosaki(6632)

Pioneering Portfolio Management by David F. Swensen(6300)

Man-made Catastrophes and Risk Information Concealment by Dmitry Chernov & Didier Sornette(6019)

Zero to One by Peter Thiel(5801)

Secrecy World by Jake Bernstein(4752)

Millionaire: The Philanderer, Gambler, and Duelist Who Invented Modern Finance by Janet Gleeson(4478)

The Age of Surveillance Capitalism by Shoshana Zuboff(4291)

Skin in the Game by Nassim Nicholas Taleb(4248)

The Money Culture by Michael Lewis(4207)

Bullshit Jobs by David Graeber(4190)

Skin in the Game: Hidden Asymmetries in Daily Life by Nassim Nicholas Taleb(4004)

The Dhandho Investor by Mohnish Pabrai(3764)

The Wisdom of Finance by Mihir Desai(3746)

Blockchain Basics by Daniel Drescher(3581)